How to Trade Multipliers in Deriv

What are multipliers?

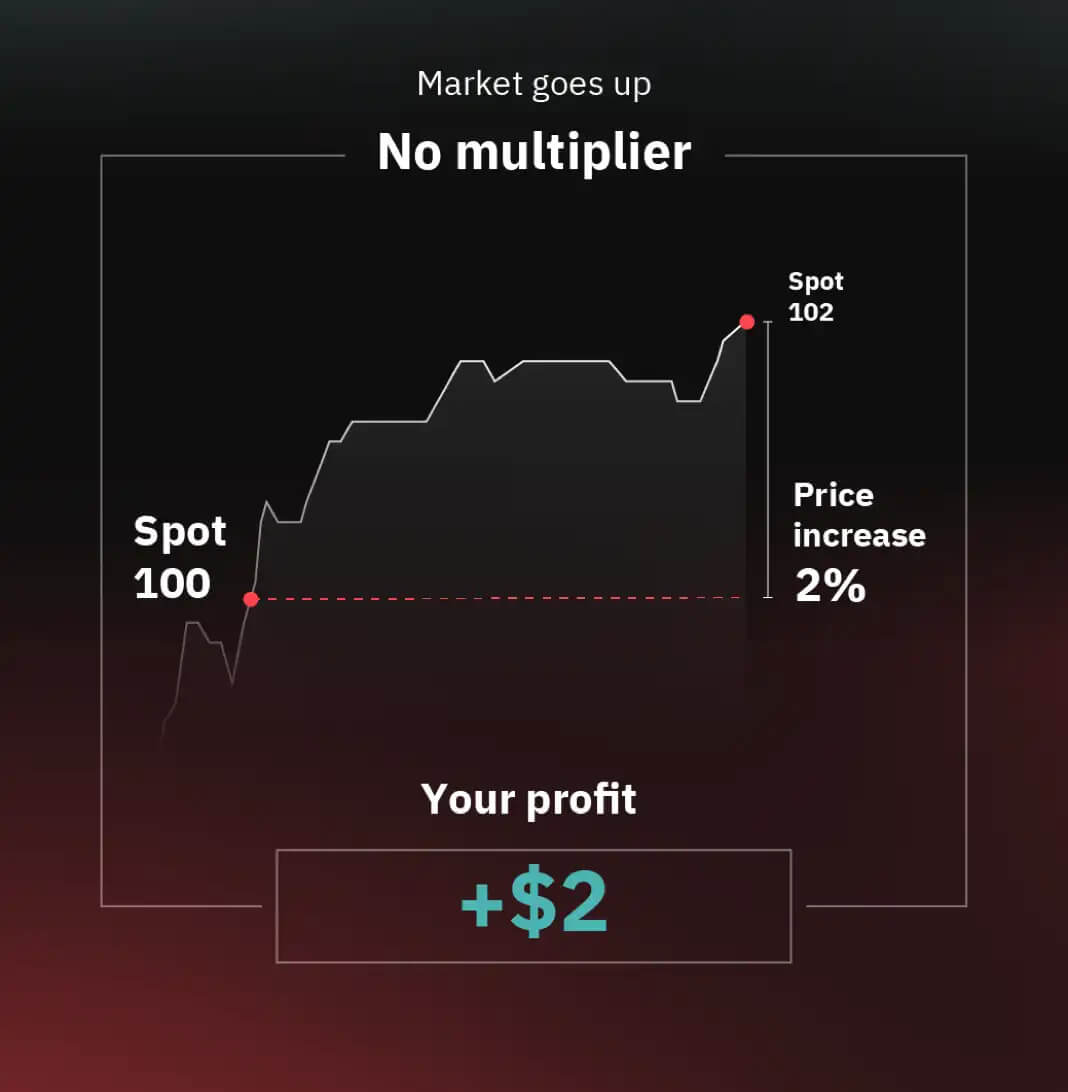

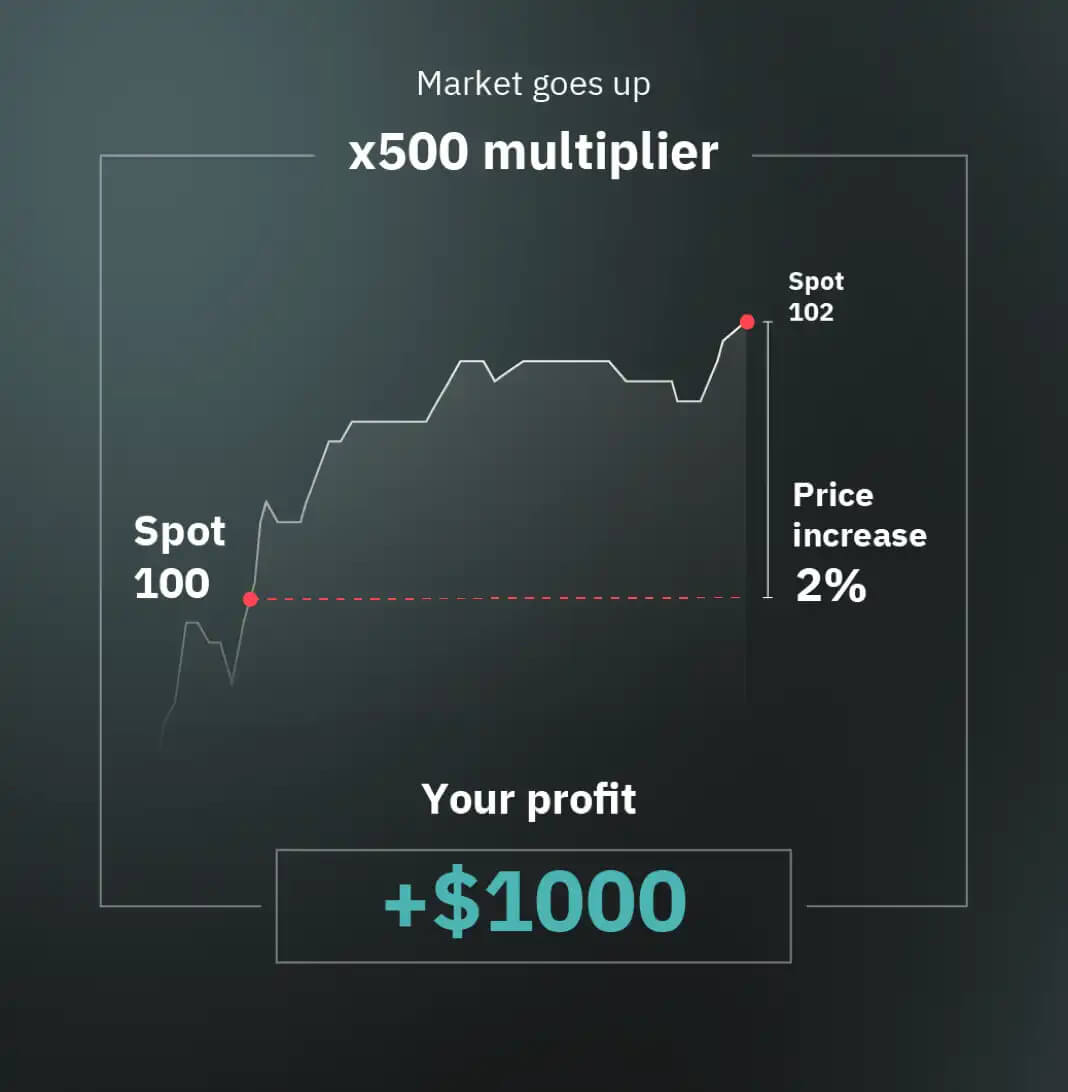

Deriv multipliers combines the upside of leverage trading with the limited risk of options. This means that when the market moves in your favour, youll multiply your potential profits. If the market moves against your prediction, your losses are limited only to your stake.Let’s say you predict that the market will go up.

Without a multiplier, if the market goes up by 2%, youll gain 2% * $100 = $2 profit.

With a x500 multiplier, if the market goes up by 2%, youll gain 2% * $100 * 500 = $1,000 profit.

With an equivalent $100 margin trade, with 1:500 leverage, you risk 2% * $50,000 = $1,000 loss.

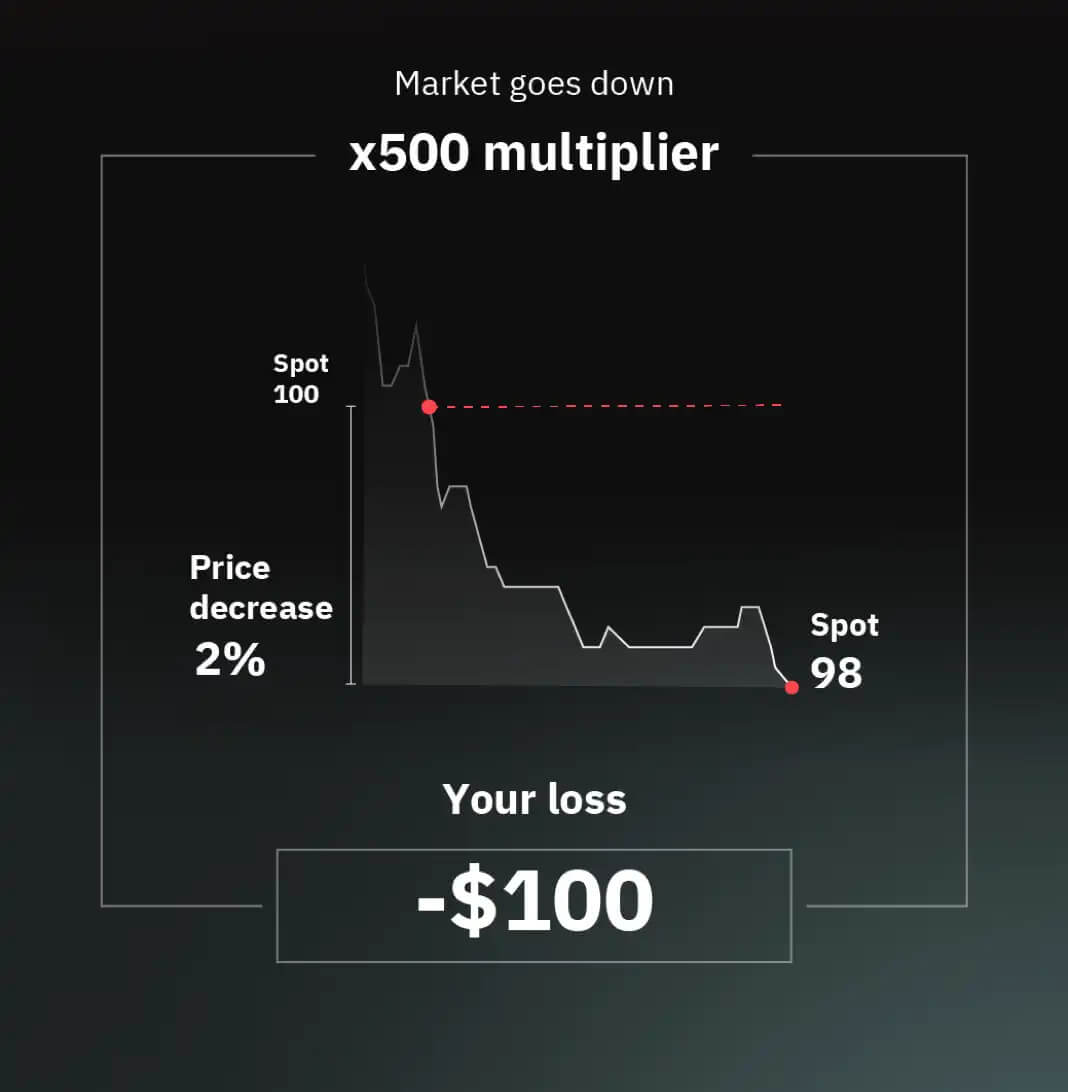

With a x500 multiplier, if the market goes down 2%, youll lose only $100. An automatic stop out kicks in if your loss reaches your stake amount.

Instruments available to trade on Multipliers

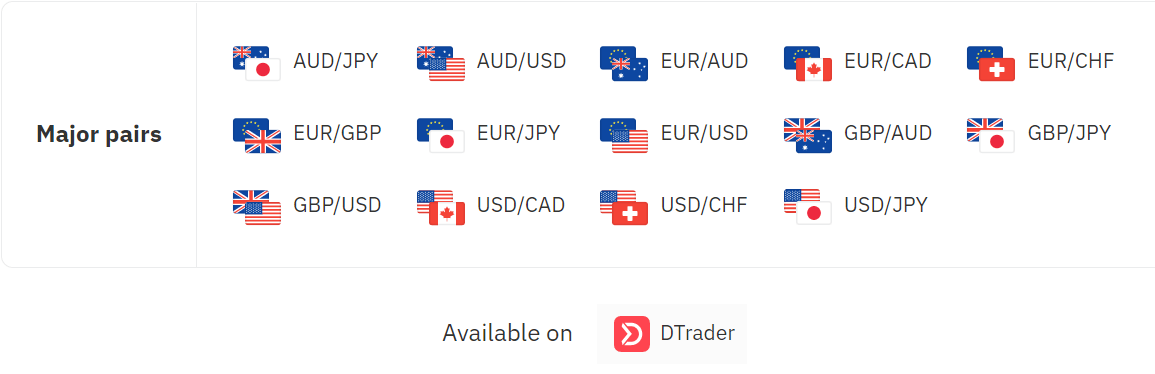

Forex

Trade Forex with multipliers for high leverage, tight spreads and benefit from multiple opportunities to trade on world events.

Forex pairs available for Multipliers trading

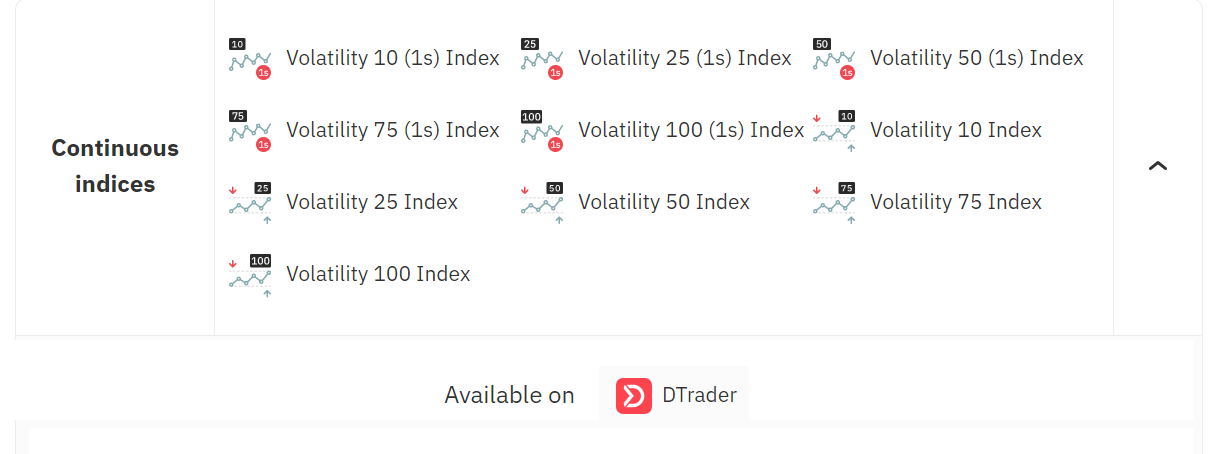

Synthetic Indices

Synthetic indices are engineered to mimic real-world market movement; minus real life risk. Trade multipliers on Synthetic Indices 24/7 and benefit from high leverage, tight spreads and fixed generation intervals.

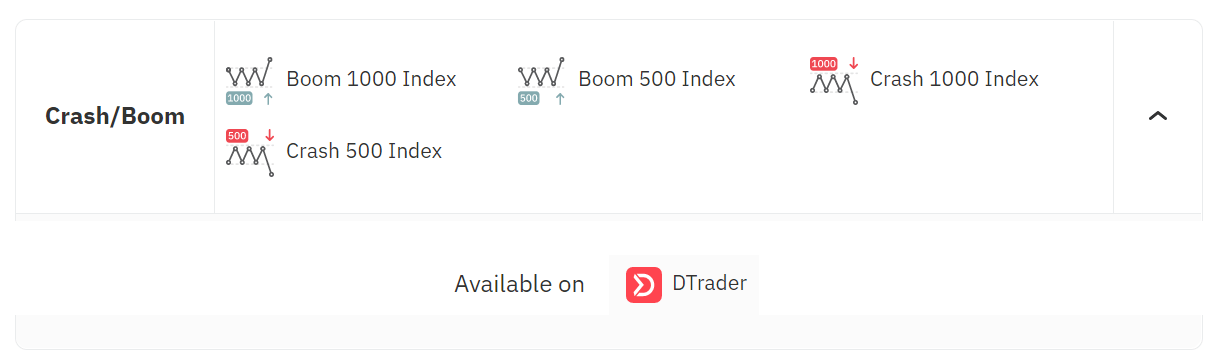

Synthetics indices available for Multipliers trading

With these indices, there is an average of one drop (crash) or one spike (boom) in prices that occur in a series of 1000 or 500 ticks.

These indices correspond to simulated markets with constant volatilities of 10%, 25%, 50%, 75%, and 100%.

One tick is generated every two seconds for volatility indices 10, 25, 50, 75, and 100.

One tick is generated every second for volatility indices 10 (1s), 25 (1s), 50 (1s), 75 (1s), and 100 (1s).

Why trade multipliers on Deriv

Better risk management

- Customise your contracts to suit your style and risk appetite using innovative features like stop loss, take profit, and deal cancellation.

Increased market exposure

- Get more market exposure while limiting risk to your stake amount.

Secure, responsive platform

- Enjoy trading on secure, intuitive platforms built for new and expert traders.

Expert and friendly support

- Get expert, friendly support when you need it.

Trade 24/7, 365 days a year

- Offered on forex and synthetic indices, you can trade multipliers 24/7, all-year-round.

Crash/Boom indices

- Predict and gain from exciting spikes and dips with our Crash/Boom indices.

How multipliers contracts work

Define your position

- Select the market you want to trade and set other essential parameters including trade type, stake amount, and multiplier value.

Set optional parameters

- Define optional parameters that give you more control over your trading, including stop loss, take profit, and deal cancellation.

Purchase your contract

- Purchase the contract if you are satisfied with the position you have defined.

How to buy your first multipliers contract on DTrader

Define your position

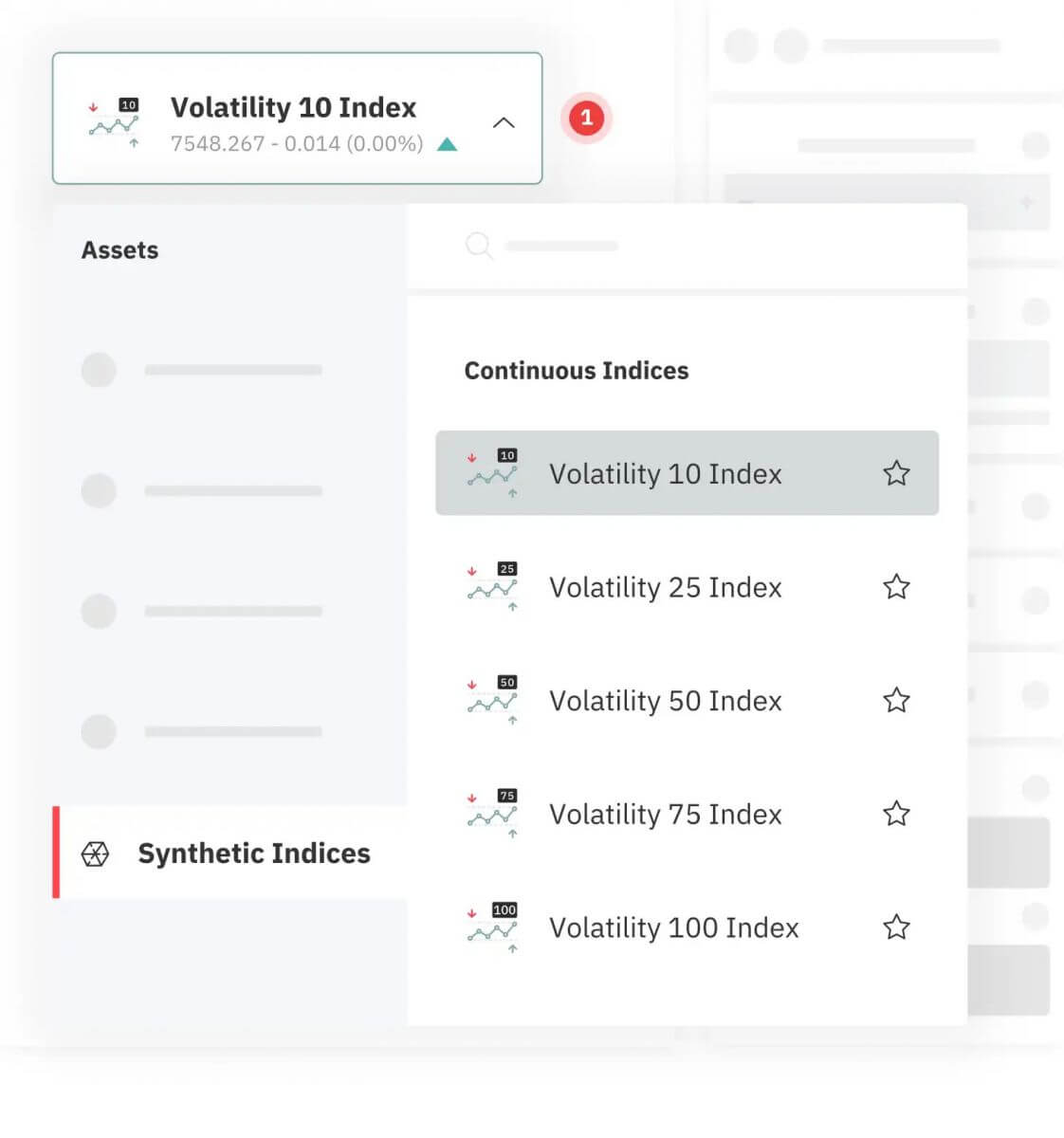

1. Market

- Choose an asset from the list of markets offered on Deriv.

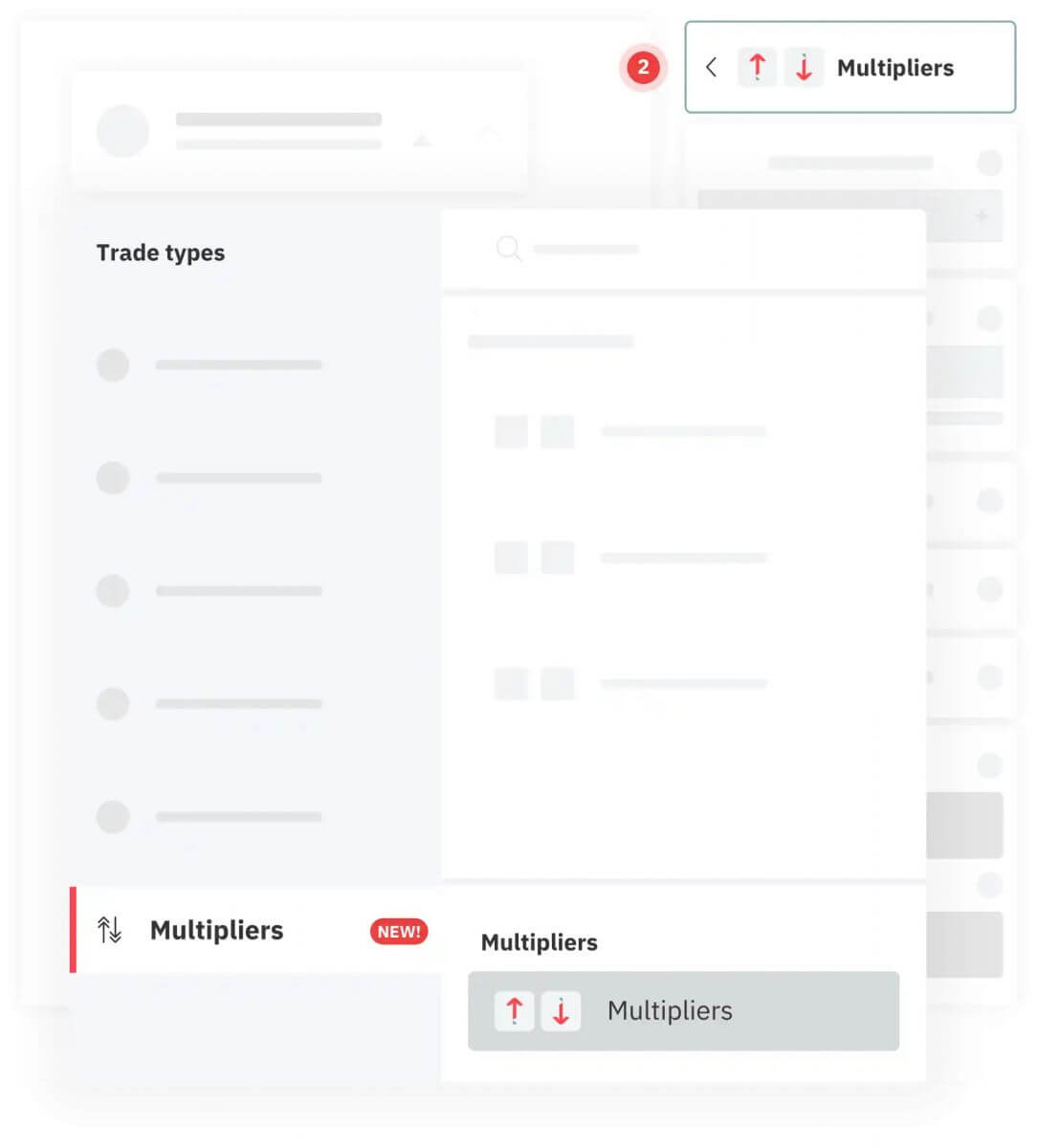

2. Trade type

- Choose ‘Multipliers’ from the list of trade types.

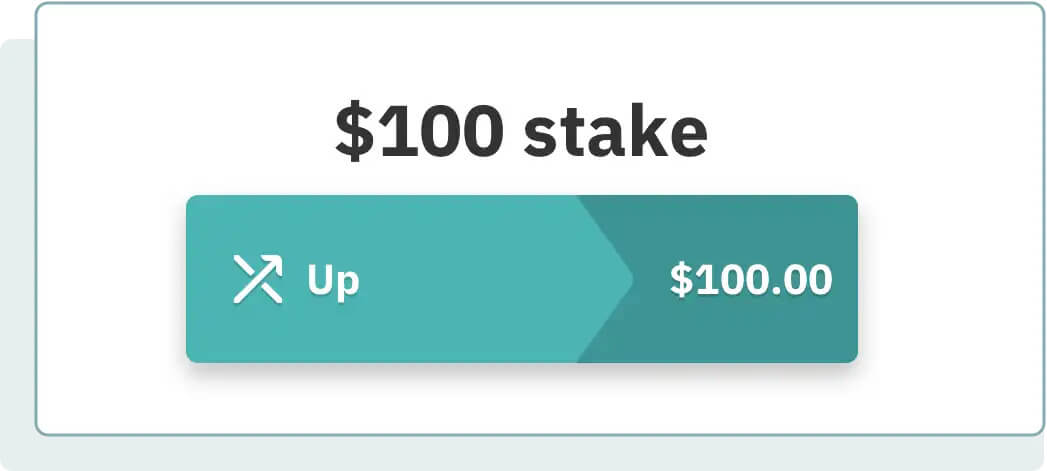

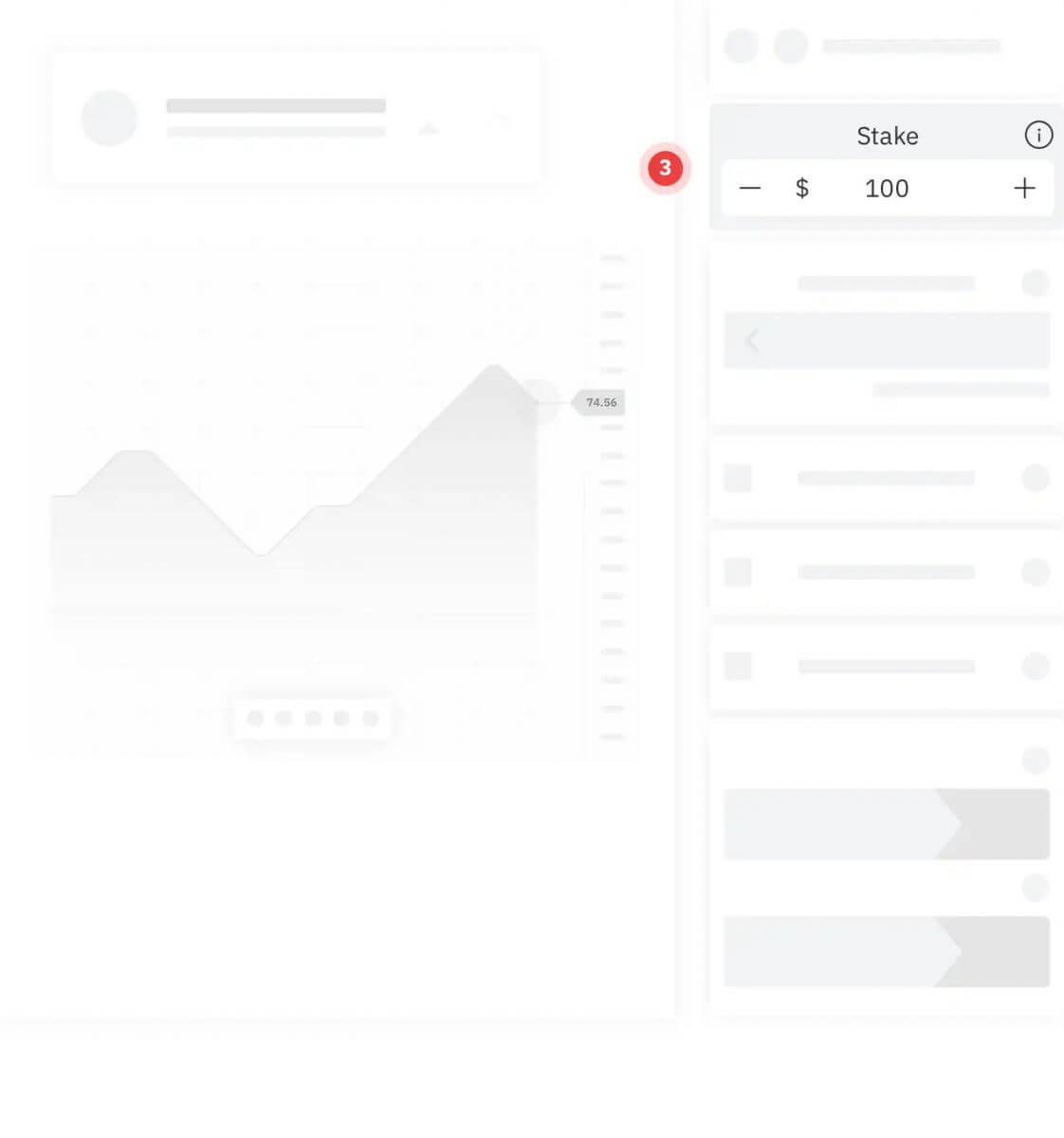

3. Stake

- Enter the amount you wish to trade with.

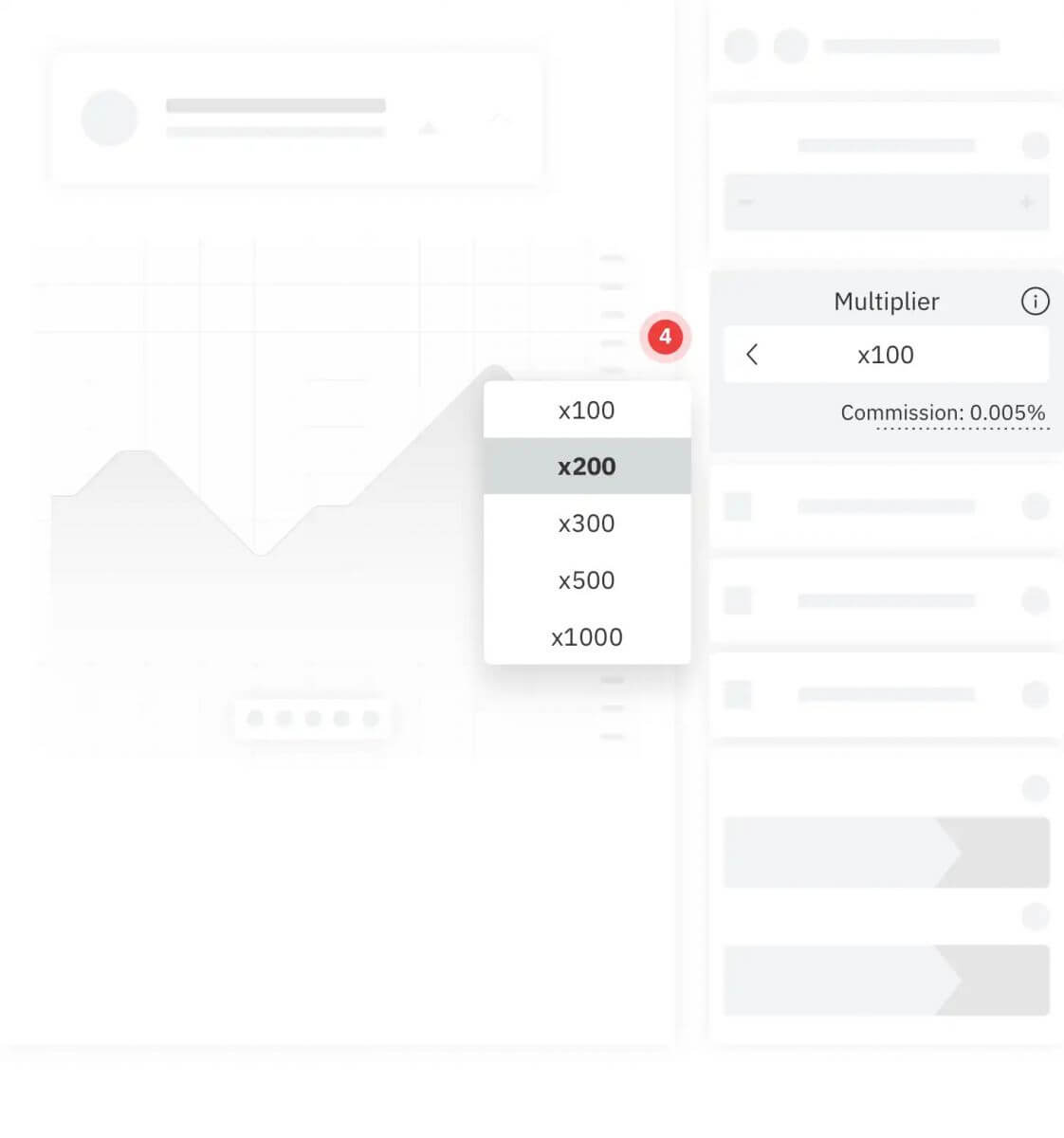

4. Multiplier value

- Enter the multiplier value of your choice. Your profit or loss will be multiplied by this amount.

Set optional parameters for your trade

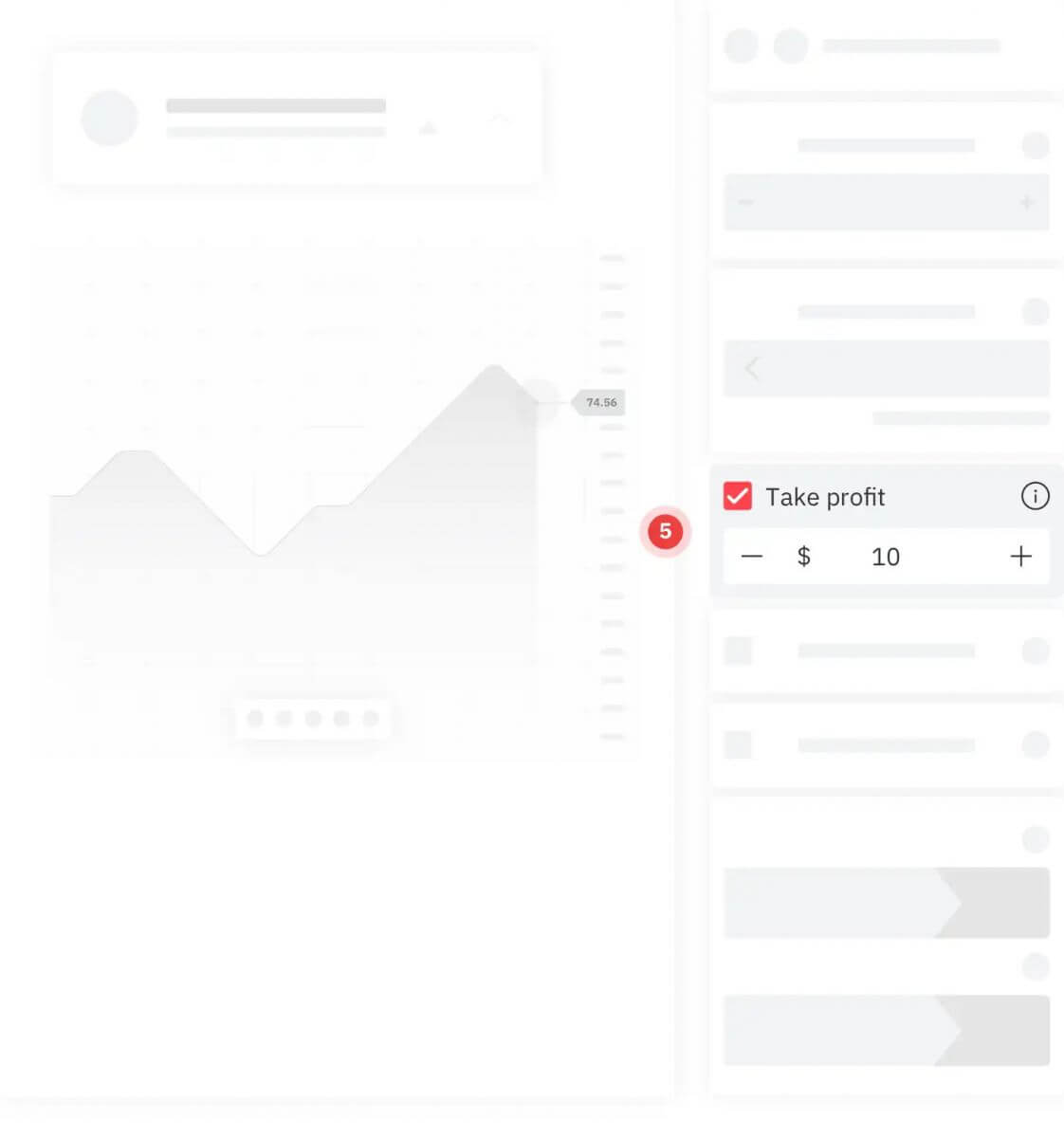

5. Take profit

- This feature allows you to set the level of profit that you are comfortable with when the market moves in your favour. Once the amount is reached, your position will be closed automatically and your earnings will be deposited into your Deriv account.

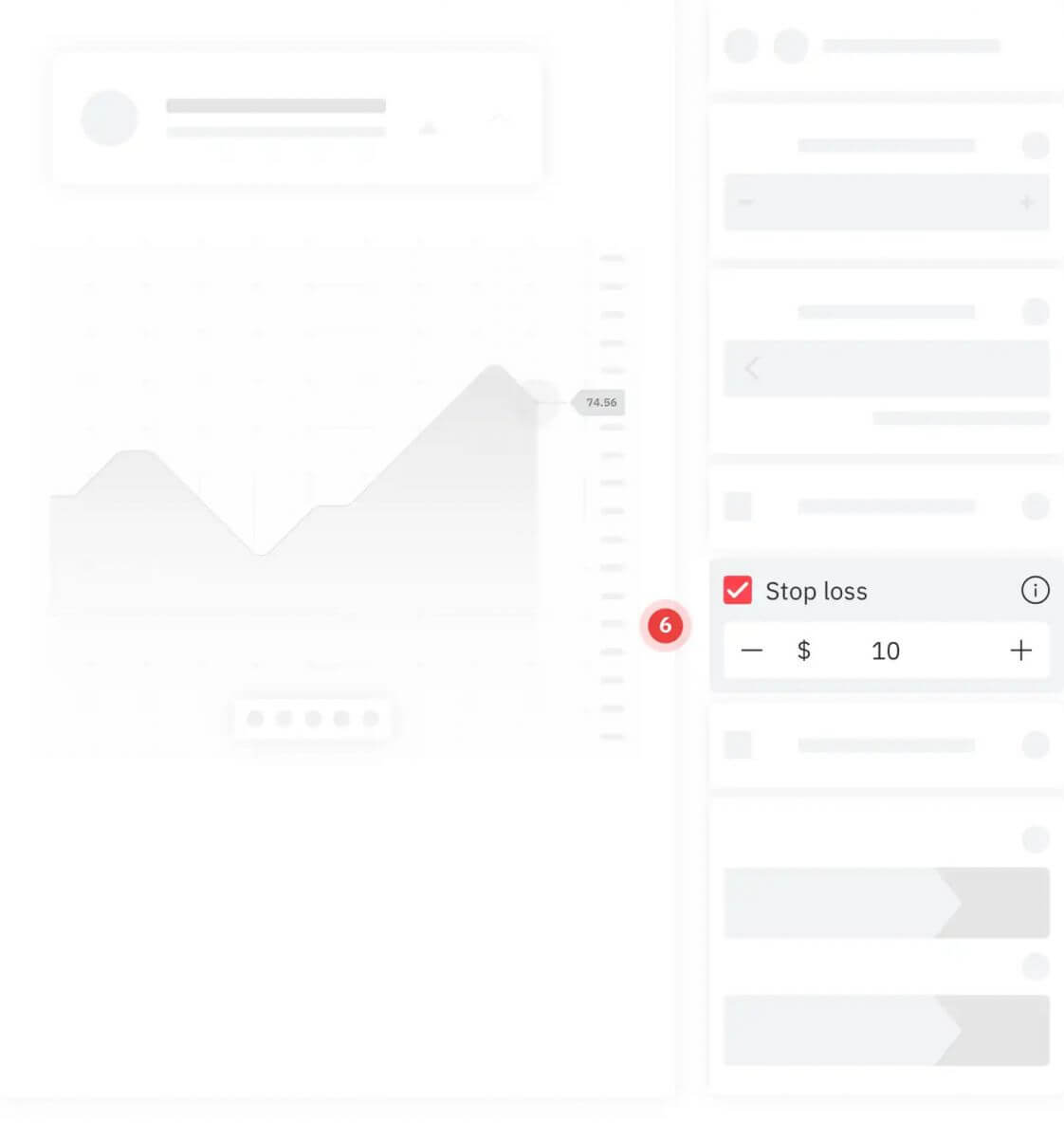

6. Stop loss

- This feature allows you to set the amount of loss you are willing to take in case the market moves against your position. Once the amount is reached, your contract will be closed automatically.

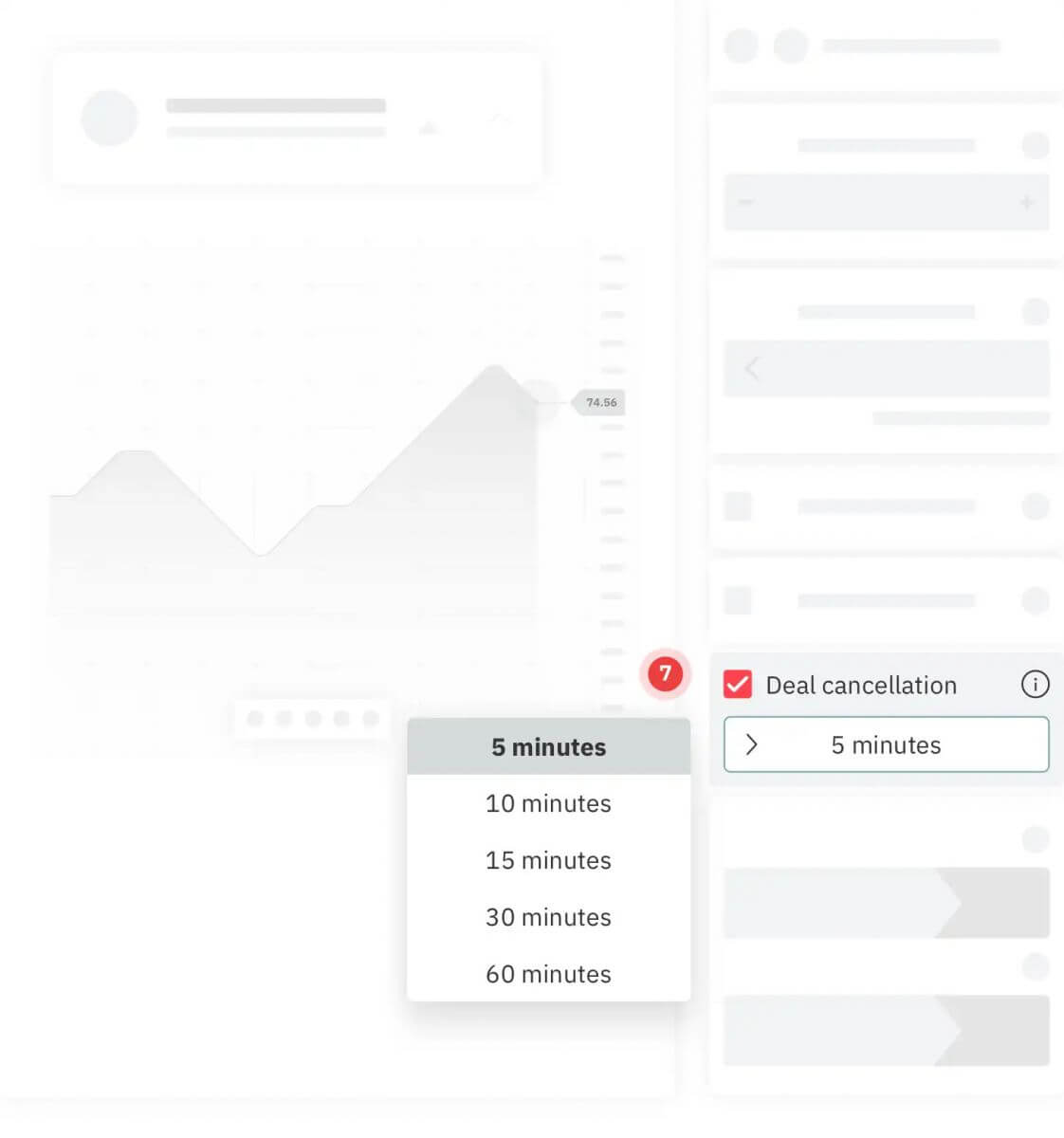

7. Deal cancellation

- This feature allows you to cancel your contract within one hour of buying it, without losing your stake amount. We charge a small non-refundable fee for this service.

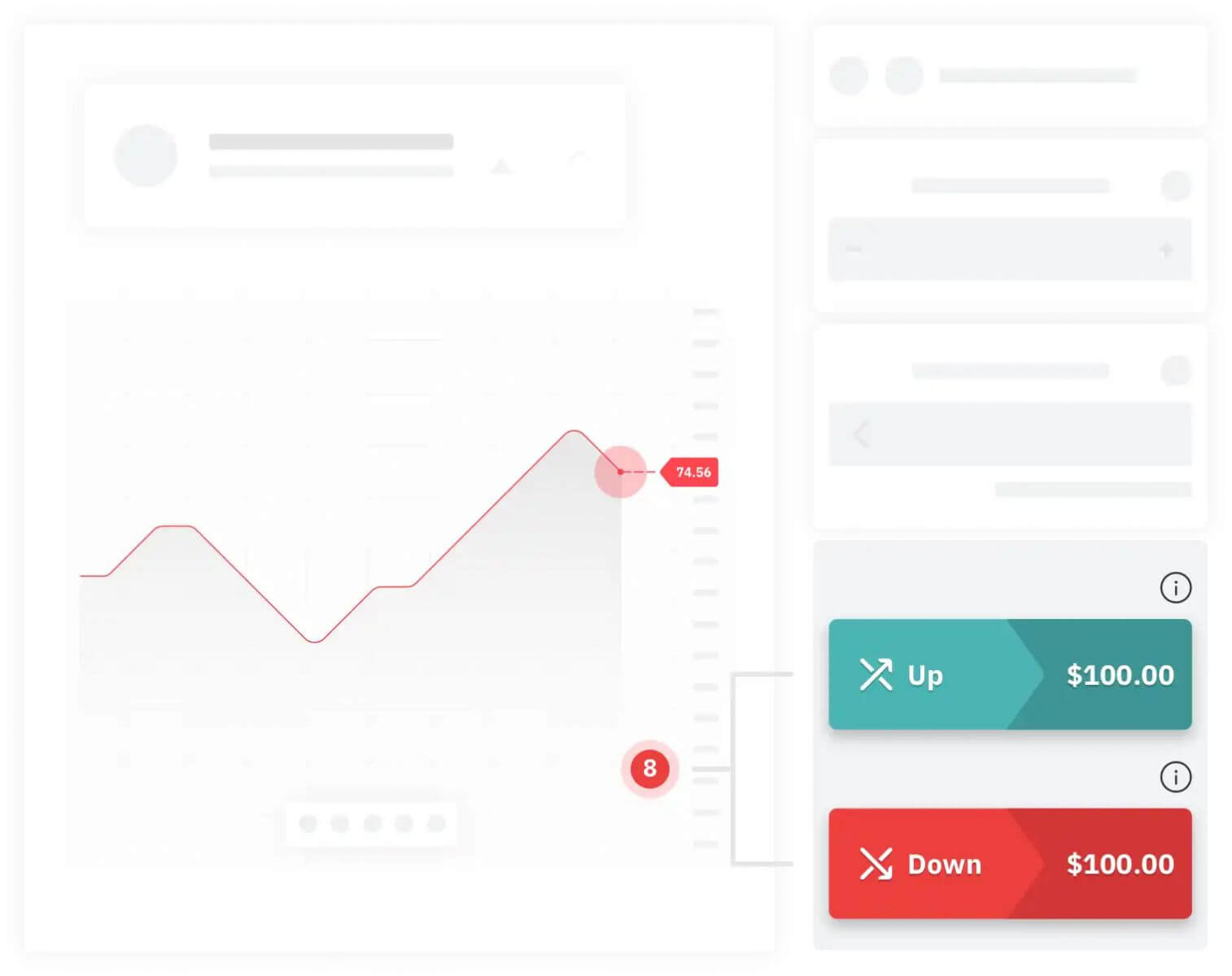

Purchase your contract

8. Purchase your contract

- Once you are satisfied with the parameters that you have set, select either ‘Up’ or ‘Down’ to purchase your contract. Otherwise, continue to customise the parameters and place your order when you are satisfied with the conditions.

Things to keep in mind when trading multipliers

Stop outWith or without a stop loss in place, we will close your position if the market moves against your prediction and your loss reaches the stop-out price. The stop-out price is the price at which your net loss is equal to your stake.

Multipliers on Crash and Boom

Deal cancellation isn’t available for Crash and Boom indices. The stop-out feature will close your contract automatically when your loss reaches or exceeds a percentage of your stake. The stop-out percentage is shown below your stake on DTrader and varies according to your chosen multiplier.

You can’t use stop loss and deal cancellation features at the same time.

This is to protect you from losing your money when using deal cancellation. With deal cancellation, you are allowed to reclaim your full stake amount if you cancel your contract within an hour of opening the position. Stop loss, on the other hand, will close your contract at a loss if the market moves against your position. However, once the deal cancellation expires, you can set a stop loss level on the open contract.

You can’t use take-profit and deal cancellation features at the same time.

You can’t set a take-profit level when you purchase a multipliers contract with deal cancellation. However, once the deal cancellation expires, you can set a take profit level on the open contract.

Cancel and close features are not allowed simultaneously.

If you purchase a contract with deal cancellation, the ‘Cancel’ button allows you to terminate your contract and get back your full stake. On the other hand, using the ‘Close’ button lets you terminate your position at the current price, which can lead to a loss if you close a losing trade.

FAQ

What is DTrader?

DTrader is an advanced trading platform that allows you to trade more than 50 assets in the form of digitals, multiplier, and lookback options.

What is Deriv X?

Deriv X is an-easy-to-use trading platform where you can trade CFDs on various assets on a platform layout that you can customise according to your preference.

What is DMT5?

DMT5 is the MT5 platform on Deriv. It is a multi-asset online platform designed to give new and experienced traders access to a wide range of financial markets.

What are the major differences between DTrader, Deriv MT5 (DMT5) and Deriv X?

DTrader allows you to trade more than 50 assets in the form of digital options, multipliers, and lookbacks.Deriv MT5 (DMT5) and Deriv X are both multi-asset trading platforms where you can trade spot forex and CFDs with leverage on multiple asset classes. The major difference between them is platform layout — MT5 has a simple all-in-one view, while on Deriv X you can customise the layout according to your preference.

What are the differences between the DMT5 Synthetic Indices, Financial and Financial STP accounts?

The DMT5 Standard account offers new and experienced traders high leverage and variable spreads for maximum flexibility.

The DMT5 Advanced account is a 100% A Book account where your trades are passed straight through to the market, giving you direct access to forex liquidity providers.

The DMT5 Synthetic Indices account allows you to trade contracts for difference (CFDs) on synthetic indices that mimic real-world movements. It is available for trading 24/7 and audited for fairness by an independent third party.